44+ how much should mortgage be based on income

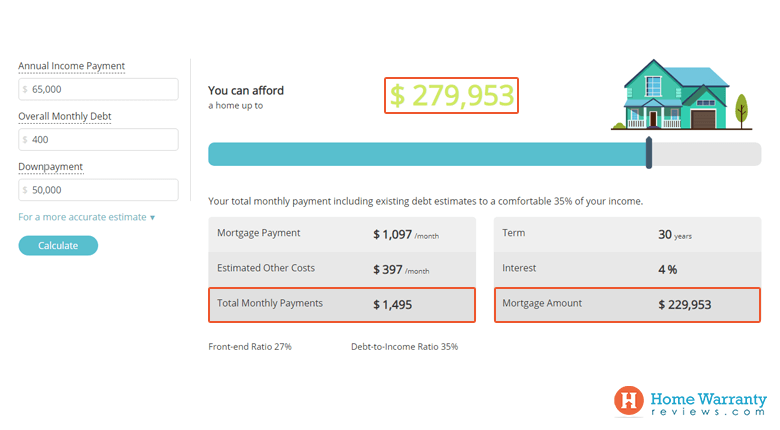

Web Mortgage affordability calculator Find out how much house you can afford with our mortgage affordability calculator. Web Most lenders do not want your total debts including your mortgage to be more than 36 percent of your gross monthly income.

How Much Mortgage Can I Afford Tips For Getting Approved For The Largest Loan Possible Investor S Business Daily

Ideal debt-to-income ratio for a mortgage For conventional loans.

. Web This model states your total monthly debt should be 25 or less of your post-tax income. Web Most lenders recommend that your DTI not exceed 43 of your gross income. Veterans Use This Powerful VA Loan Benefit for Your Next Home.

Get Instantly Matched With Your Ideal Mortgage Loan Lender. Web She says a good rule of thumb is to use a 25 percent share of mortgage payment to income which considers that homeowners have additional expenses such as. 43 043 x 5000 2150 Max debt payments.

Remember to include property taxes homeowners. Ad Need To Know How Much You Can Afford. Check Official FHA Loan Requirements.

Web The rule of thumb is that you can afford a mortgage where your monthly housing costs are no more than 32 of your gross household income and where your total debt load. Well Help You Estimate Your Monthly Payment. Web Based on your monthly income of 6000 your back-end ratio would be about 44 percent.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Web You can find this by multiplying your income by 28 then dividing that by 100. 5000 x 028 28 1400.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. 1000 Max home expenses. Compare Home Financing Options Online Get Quotes.

Ad Finance raw land with fixed or variable rates flexible payments and no max loan amount. Web If paying a mortgage would mean your total monthly spending on paying down debt is higher than 36 percent of your income you may have trouble getting approved for the. Web What percentage of income do I need for a mortgage.

Save Time Money. Ad Need To Know How Much You Can Afford. 2 To calculate your maximum monthly debt based on this ratio multiply your.

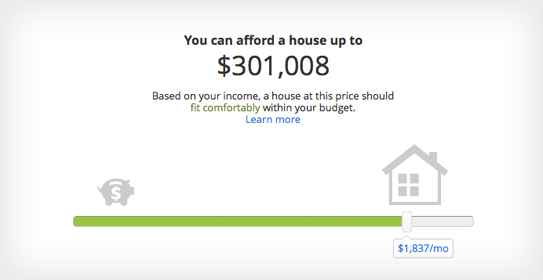

Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best. Get an estimated home price and monthly mortgage. Web How much mortgage can you afford.

A conservative approach is the 28 rule which suggests you shouldnt spend more than 28 of your gross monthly income. Web Your housing payment shouldnt be more than 2170 to 2520. Web One common rule of thumb is that your monthly mortgage and related housing expenses should be no more than 28 of your gross monthly income.

Estimate your monthly mortgage payment. Determining your monthly mortgage payment. Lets say you earn 5000 after taxes.

To calculate how much you can afford with the. Ad Calculate Your Payment with 0 Down. Web Based on the 28 percent and 36 percent models heres a budgeting example assuming the borrower has a monthly income of 5000.

Compare Home Financing Options Online Get Quotes. Web This means that if you want to keep your DTI ratio at 43 you should spend no more than 18 900 of your gross income on your monthly payment. Try our mortgage calculator.

Your maximum monthly mortgage. Ad Calculate Your FHA Loan Payment Fees More with an FHA Mortgage Lender. Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income and.

For example lets say your pre-tax monthly income is 5000. Well Help You Estimate Your Monthly Payment. Get an idea of your estimated payments or loan possibilities.

However how much you. Back-end DTI adds your existing debts to your proposed mortgage payment. Ad Find How Much House Can I Afford.

See If You Qualify for Low Down Payment. Web Now you know you can only afford a new home if the total monthly payment comes out to 1150 or less. Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac.

Ad See how much house you can afford.

44 Business Ideas In Chennai For 2023 100 Actionable Profit Making Business

What Percentage Of Income Should Go To A Mortgage Bankrate

Home Affordability Calculator

First Community Mortgage Startseite Facebook

The Income Required To Qualify For A Mortgage The New York Times

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Affordability Calculator How Much House Can I Afford Zillow

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

Isle Of Man Portfolio Jan 22 By Keith Uren Issuu

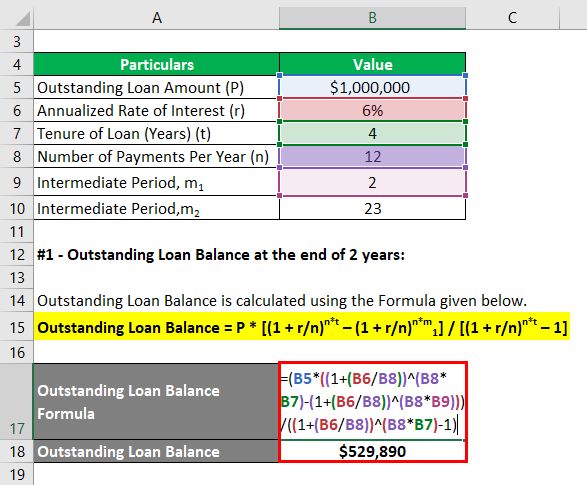

Mortgage Formula Examples With Excel Template

Premium Photo Top View Owe Asian Woman Female Sitting On Floor Stressed And Confused By Calculate Expense From Invoice Or Bill Have No Money To Pay Mortgage Or Loan Debt Bankruptcy

Mortgage Broker Taree Forster Better Loan Rates Mortgage Choice

How Much House Can You Afford Readynest

Best Brokerage Accounts For Beginners Moneyunder30

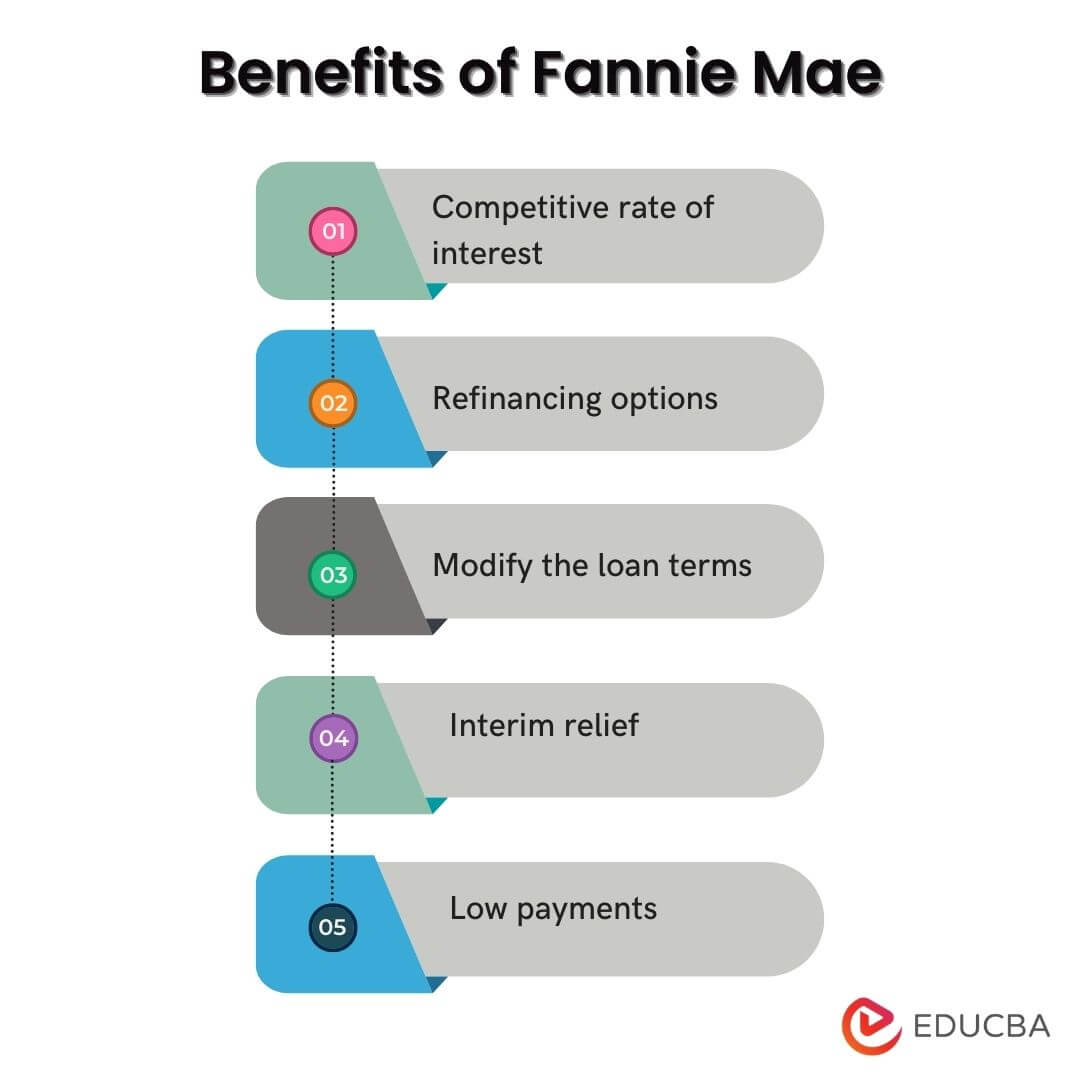

What Is Fannie Mae Purpose Eligibility Limits Programs

Learning Latent Representations Of Bank Customers With The Variational Autoencoder Sciencedirect

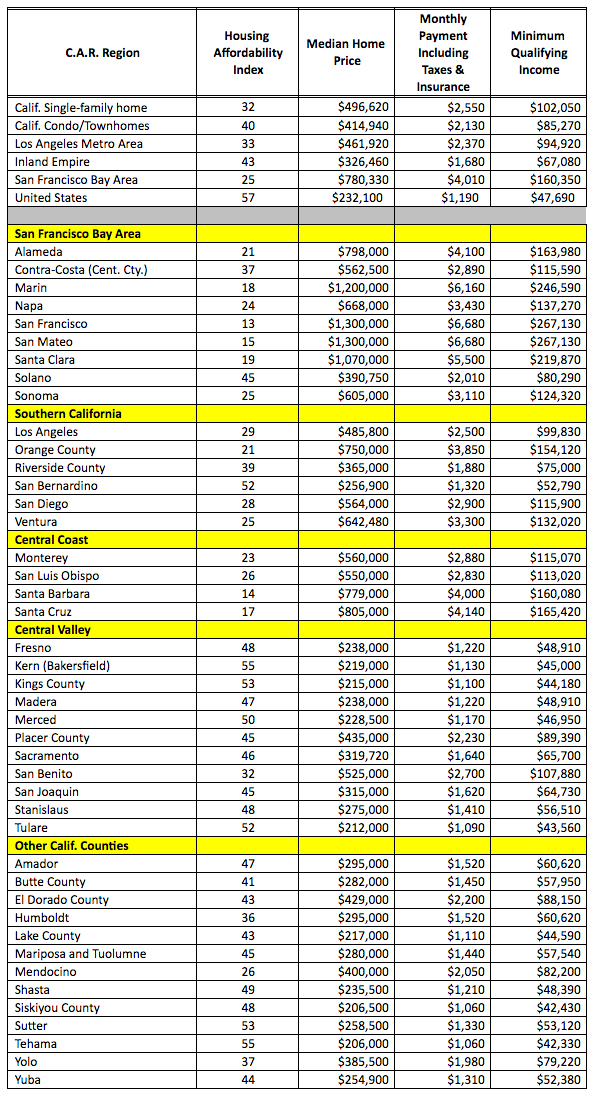

Need A Mortgage In California Realtors Say You Better Earn This Much Money Housingwire